Generative AI Integration in Applications: The Next Frontier of Software Innovation

Tue 16/12/2025 read 2557 views

What Are xStocks? Understanding Tokenized Stocks and the Platform Behind Them

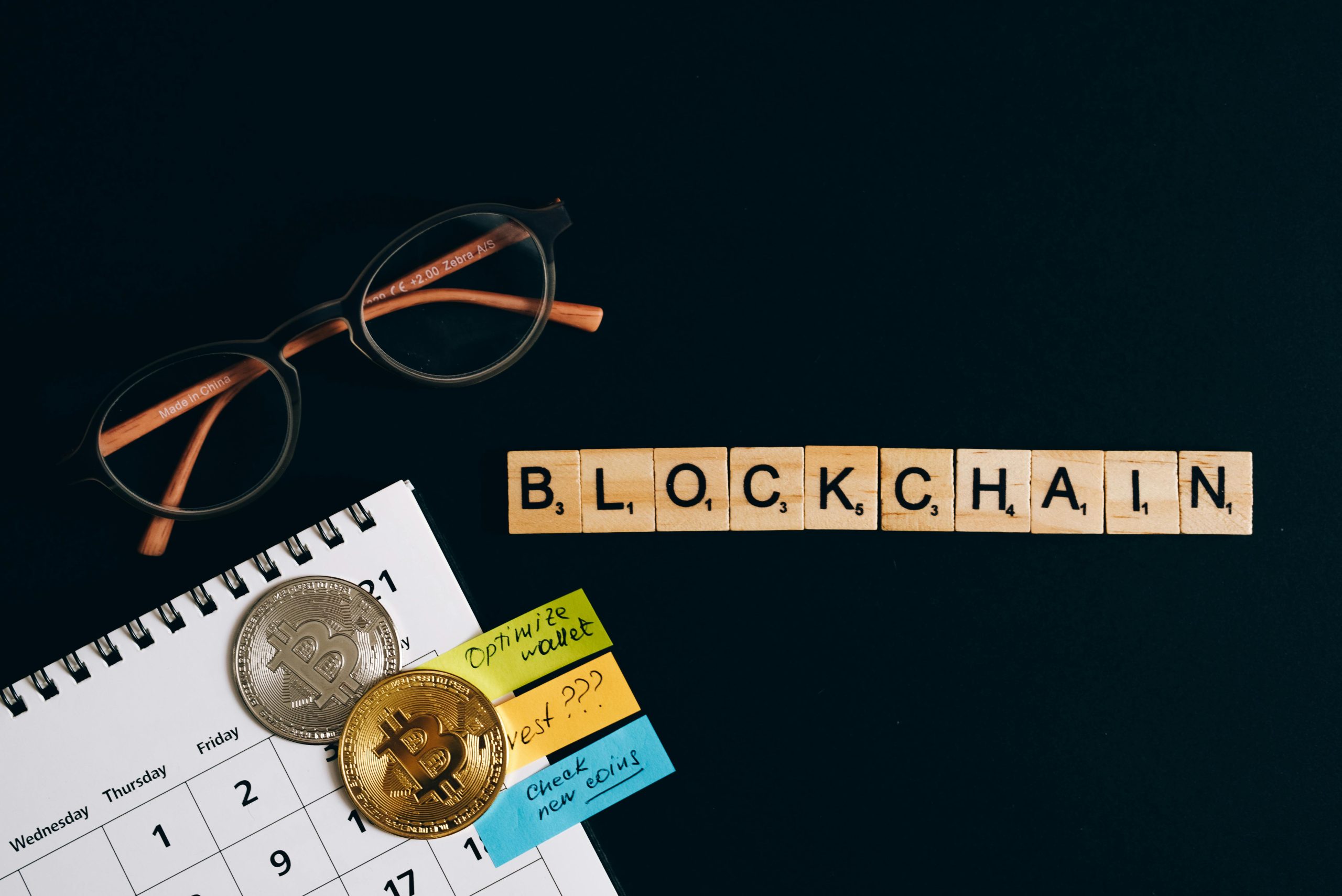

The Rise of Tokenized Stocks

The line between traditional finance and blockchain technology is rapidly blurring. One of the most exciting innovations at this intersection is xStocks, a product that allows users to gain exposure to real-world U.S. equities and ETFs through blockchain-based tokens.

Launched by Kraken in partnership with Backed Assets, xStocks make it possible to trade and hold fractional, tokenized versions of major U.S. stocks like Apple, Tesla, and Microsoft — securely and transparently on the blockchain.

This article breaks down what xStocks are, how they work, and why tokenized stocks could reshape investing as we know it.

What Are xStocks?

xStocks are tokenized representations of real U.S. stocks and exchange-traded funds (ETFs).

Each xStock token is backed 1:1 by the actual underlying asset held by Backed Assets (JE) Limited, the issuer, and offered via Kraken to eligible customers.

Essentially, when you buy an xStock, you’re buying a blockchain-based claim on a real share of a U.S. company — just in a tokenized form.

How xStocks Work

- Backing: Each xStock represents a single share of the underlying stock, custodied by Backed Assets.

- Trading: Users can trade xStocks on Kraken’s platform (Standard or Pro) similarly to cryptocurrencies.

- Fractional Ownership: You don’t need to buy a full share — fractional amounts are possible.

- Dividends: Dividends are automatically reinvested, increasing your token holdings.

- Availability: Currently, xStocks are not available to residents of the U.S., Canada, or certain other restricted jurisdictions.

The Platform Behind xStocks: Kraken + Backed Assets

The xStocks initiative is powered by two major players:

- Kraken– a globally trusted crypto exchange that provides the marketplace for users to buy, sell, and hold xStocks.

- Backed Assets (JE) Limited– a regulated issuer and custodian responsible for holding the real-world shares that back each tokenized stock.

Together, they create a transparent and compliant bridge between traditional stock markets and decentralized finance (DeFi) ecosystems.

Key Benefits of xStocks

1. Global Accessibility

xStocks make U.S. equities accessible to investors around the world — including those who may not have access to traditional brokerage accounts.

2. Fractional Investment

You can own small portions of expensive stocks like Tesla or Amazon, allowing for portfolio diversification even with modest capital.

3. 24/5 Trading Hours

Unlike traditional stock markets with limited hours, xStocks can be traded around the clock on weekdays.

4. Transparency and Efficiency

Blockchain ensures that ownership records are immutable and verifiable. Transactions settle faster and with fewer intermediaries.

5. On-Chain Utility and Interoperability

Some xStocks can be withdrawn to blockchain wallets, allowing integration with DeFi protocols, yield strategies, or tokenized portfolios.

6. Auto-Reinvested Dividends

Dividends are automatically reinvested into your token holdings, helping you build compounding exposure seamlessly.

What Investors Should Know

While the potential of tokenized stocks is huge, investors should be aware of certain risks and limitations.

No Traditional Shareholder Rights

Holding an xStock does not grant voting or direct shareholder rights in the underlying company.

Regulatory Uncertainty

xStocks operate under evolving digital asset laws. Availability depends on jurisdiction, and compliance requirements may change over time.

Custody and Counterparty Risk

The safety of your tokenized shares depends on the custodial practices of the issuer (Backed Assets). It’s vital to trust their 1:1 backing and audits.

Fees and Spreads

Trading, withdrawal, or currency conversion fees may apply. Always check Kraken’s latest pricing details.

Availability Restrictions

xStocks are not offered in some countries, including the U.S. and Canada, due to regulatory restrictions.

The Future of Tokenized Stocks

Tokenized equities like xStocks represent the future of global investing — one where:

- Stocks are traded 24/7 without intermediaries.

- Investors can own assets across borders with a few clicks.

- Real-world value flows seamlessly into DeFi applications.

As regulation evolves and technology matures, we can expect broader availability, more supported assets, and even deeper integration with decentralized financial systems.

Projects like xStocks show how tokenization is transforming traditional finance (TradFi) into a more open, programmable, and inclusive ecosystem.

Final Thoughts

xStocks by Kraken and Backed Assets are more than just tokenized shares — they’re a proof of concept for the next era of investing.

By bringing real-world assets onto blockchain, xStocks give investors flexibility, transparency, and access that traditional markets can’t match.

But like all new technologies, they require awareness, due diligence, and regulatory understanding.

If you’re exploring xStocks or tokenized equities, always:

- Check your jurisdiction’s eligibility.

- Understand how the tokens are backed and audited.

- Keep security and custody in mind.

The tokenization of stocks is no longer a theory — it’s a reality. And xStocks are leading the way toward a truly on-chain financial future.

Related articles